Netflix logo minimal simple design template. copy space 3d

Netflix’s earnings hit this week and new co-CEOs Ted Sarandos and Greg Peters «are very pleased with the quarter.» Not bad for your first earnings call. The «business as usual» vibes had to be very welcome for the newly named double act, coming from the 2022 drama when you had:

- Q1/Q2: LOSS of subscribers at the transmitter for the first time in a decade

- P3: Pivot to ad tier announced

- Q4: Reed Hastings exit as season finale

At this time, the ship appears to be stable to Ted and Greg. Shall we call them Ted and Greg or Greg and Ted? I think Ted and Greg. If it were the title of a children’s show, it would have to be Gregory and Ted, à la Phineas and Ferb, with that nice meter of syllables. I’m digressing

Key headlines from Netflix Q1 2023 earnings

Crackdown on password sharing expands… The results of the initial test markets have been positive. There are just a few issues to iron out to make the experience even smoother for users, but Netflix is ready to target «high viewer penetration» markets, including the US, soon.

Advertising evolves… He is still in a tracking phase, but is looking for a ride by the end of the year. Better targeting and measurement are part of this progress. Interestingly, the ad-tier revenue per subscriber is actually higher than a standard subscription plan.

No! No! No! No! No! (slight paraphrase) They’re not doing theatrical releases!… Ted Sarandos talked about this, despite the success seen by glass onion:

“Taking people to the theater is simply not our business. We create that demand, we collect that demand in our subscription service with our members. And I think having great, new, desirable content, including feature films in the first window, drives value for our members and drives value for the business.”

Children’s Headlines:

It appears that news and media accolades for children have declined in recent quarters. This time they were as low as a near conspicuous absence for the first time since I began writing these articles in 2020. The only mention was the Academy Award win for Guillermo del Toro pinocchio. An impressive feat, which I’ll go into more detail in a minute.

On consumer products, Sarandos said it once again:

“The main driver of our consumer products business is building and deepening fandom. Generate some income. But overall, we’re really looking for those opportunities to help fans connect with their favorite shows, their favorite movies, their favorite talent by wearing the t-shirt or carrying the notebook and other ways that people really like to express their hubby».

To me, this implies that CP is a marketing tool for the streamer. Any ambition to invest in this structure as a true business unit and revenue engine appears to be absent. And sure, there’s power in kids wearing a T-shirt to show their support, but there needs to be a real machine behind the content if you want to be successful.

As for games, Netflix plans to add an additional 40 titles this year to the 55 it already has. Among these newcomers are family-friendly kids brands Teenage Mutant Ninja Turtles and SpongeBob SquarePants. This area is still a slow build.

Aside from the published earnings information, there has been another interesting recent development for the children’s section of Netflix. The Trending Top 10 Rankings, a user discovery tool that provides us professionals with unscientific information about what’s hot and what’s not, has been divided into two categories. From now on we can see the 10 most popular children’s movies and the 10 most popular children’s series separately. This should give us both a bit of a deeper perspective, which is great, as the tops tend to be dominated by familiar faces like CoComelon and DreamWorks/Illumination movies.

Performance of children’s content in the first quarter of 2023

children’s series

Image: DreamWorks

Kids’ contenders for Netflix Global Hours Viewed (referred to as GHV in the future) were also in short supply this quarter, perhaps another reason why kids’ content was given little prominence. Even the highly anticipated seventh season of the original streaming franchise Gabby’s Dollhouse couldn’t get in. This essentially highlights a key weakness with the data we received on the GHV Top 10, particularly for children. The individual seasons are fragmented. So it’s easy to miss the halo viewership coming from a new season drop that picks up new viewership starting from the beginning of the series. Preschool content, which isn’t consumed like that anyway, doesn’t really stand a chance. US Nielsen streaming content ratings capture this type of consumption more sympathetically. Hopefully, we will be able to see some details about the release of Talkative season 7 when it comes out later this week.

Teen content fared better; WednesdayThe initial success of turned into a record-breaking streak. Season 2 of ginny and georgia“like the Gilmore Girls, but with bigger breasts” (quote from the show, not from Ted and Greg), also enjoyed impressive viewership.

Movies for kids

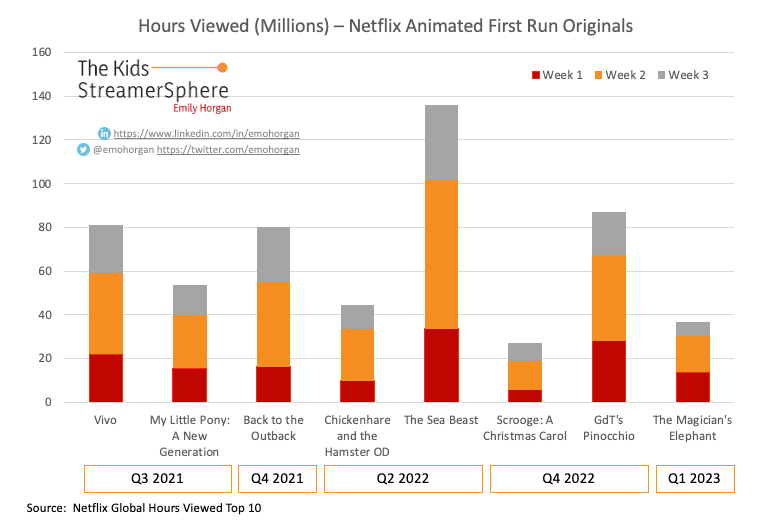

Q1 saw the first original from animation studio Animal Logic, which Netflix acquired last year. The Wizard’s Elephant it had a modest share of the GHV Top 10, dropping out after three weeks. no match for the sea beast. A little disappointing for sure, but it’s likely that most of the film was locked up at the time of acquisition. In the days of linear programming, this would have been put into an afternoon marathon, with GoT pinocchiocalled Frowny Father-Figure Friday.

As mentioned above, Pinocchio by Guillermo del Toro it won the Academy Award for best animated feature. There is no doubt that it is creatively beautiful. sarandos said:

“…the movies that earned that much were also very, very popular with the fans. So this is award-winning, critically acclaimed and hugely popular with fans… Pinocchio certainly was that. And we’re very proud of the movies that were in the mix because they were loved by the fans.»

To say that something is «enormously popular with fans» is a huge truism. You can see in the graph above that the commitment of the sea beast it was certainly older, and now has a sequel on the way. This shows that Netflix sees this title as a good bet in terms of subscriber engagement. Currently, they rely heavily on driving this type of audience through films acquired from DreamWorks and Illumination. These consistently draw audiences, both when they’re from the long-tail library and fresh from the theaters.

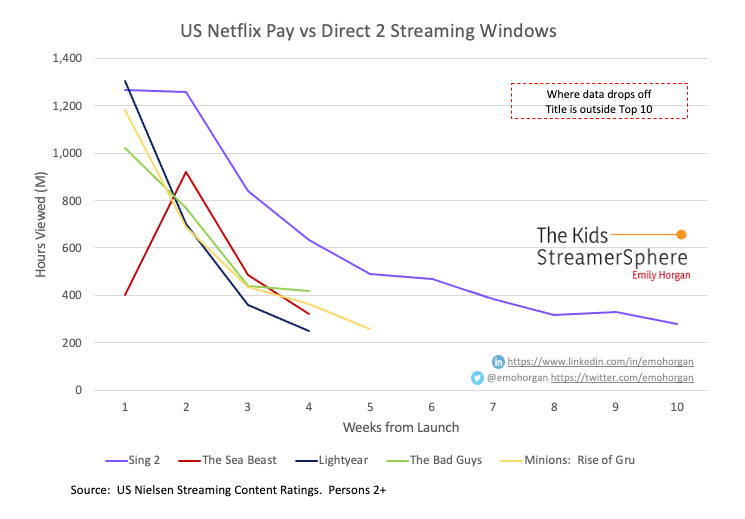

On that note, Q1 saw Minions: The Rise of Gru coming to Netflix in the United States. Buzz in this movie was very hot last summer. If you haven’t heard of gentle minions Do you even work in children’s media? It grossed over $900 million globally, $370 million of which came from the US. I was waiting Gru’s Rise to go far on Netflix. However, the results were a bit disappointing, coming much closer to Light-year and the bad boysthat did not have anywhere near the same box office.

What’s blindingly obvious from the chart above, however, is that theatrical releases don’t have a negative impact when it comes to streaming windows. @Entertainment Strategy Unpacked this across wide genres recently. I’ll go beyond animated movies in a future issue of this newsletter. Why Netflix remains averse to this approach remains a question.

What’s next for the Netflix kids?

The most important news in Netflix animation recently is, without a doubt, the announcement of a Strange things animated series original creators The Duffer Brothers are on board as executive producers, along with 21 Laps’ Shawn Levy and Dan Cohen (Night in the museum, free boy, The Adam Project). The production studio is Flying Bark Productions, which has credits such as The Rise of the Teenage Mutant Ninja Turtles and Marvel’s Moon Girl and the Devil Dinosaur. Hopefully this should make the series appealing to kids, instead of being a massive fan exercise like we’ve often seen in Star Wars and Marvel franchises.

Hopefully, more imminently the first Moonbug Original series will arrive, CoComelon Lane. Initially this was scheduled for 2022. For some reason the press release for the series made me think it would be a real departure from the standard. CoComelon format, potentially a more narrative approach. If Moonbug could successfully pull off that evolution for JJ, it would increase the potential to no end. There was a good article with managing director Andy Yeatman on Cartoon Brew recently.

Commercial series continue to do well. princess power (princesses—check, cute animals—check, music—check) had a great run in the Top 10 Kids Trends. Maybe unicorn Academy, coming from Spin Master in the same vein later in the year, he will do the same.

On the movie front, Puss in Boots: The Last Wish it should hit the streamer by the end of the second quarter, providing another data point on the theatrical vs. streaming debate. We’ll have to wait until Christmas for bigger Netflix original movies like Chicken Run: Dawn of the Nugget (Aardman) and Lion (starring Adam Sandler). Meanwhile, live-action children’s film suck is off to a good start.

So, Ted and Greg wrap up their first earnings call, mostly quiet on the Netflix front. Sure, there are some blunders, and growth didn’t live up to forecasts, but they really wouldn’t be in the CEO trenches if there weren’t trouble attending. Here’s hoping part of your plan is to revitalize yourself in terms of kid-friendly content. The list of canceled/»uncertain future» shows we tracked down on What’s on Netflix is a pretty harrowing tally of great creative talent. and while Pinocchio by Guillermo del Toro represents quite an achievement in animated storytelling, I have to wonder if investing in something that really resonated with kids would have been a better bet in the long run.